BEST Place to Work

Our associates consistently rank Supreme Lending Southeast as one of the BEST places to work in Atlanta and South Florida.

Our CultureSo much more than a mortgage lender.

Whether it's working together to become our Personal and Professional BEST or delivering a world-class service experience for our customers, our team at Supreme Lending Southeast is never complacent. We are always in pursuit of BEST.

Our associates consistently rank Supreme Lending Southeast as one of the BEST places to work in Atlanta and South Florida.

Our Culture...and we have the numbers to prove it. Our customers are highly satisfied with their experience over 98% of the time.

About UsWe believe that BEST is both a journey and a destination, and we have the program to help you meet us there.

Our Program

At Supreme Lending, we believe that achieving the American dream of homeownership is a life-changing event.

Our mortgage experts are prepared with all of the knowledge and resources you need to make your dreams become reality.

Find a Loan Officer

Each year, our associates commit the financial and volunteering resources to build a Habitat for Humanity home for a neighbor in need. Our mission compels us to put actions to our words and leave the world a better place.

Learn More

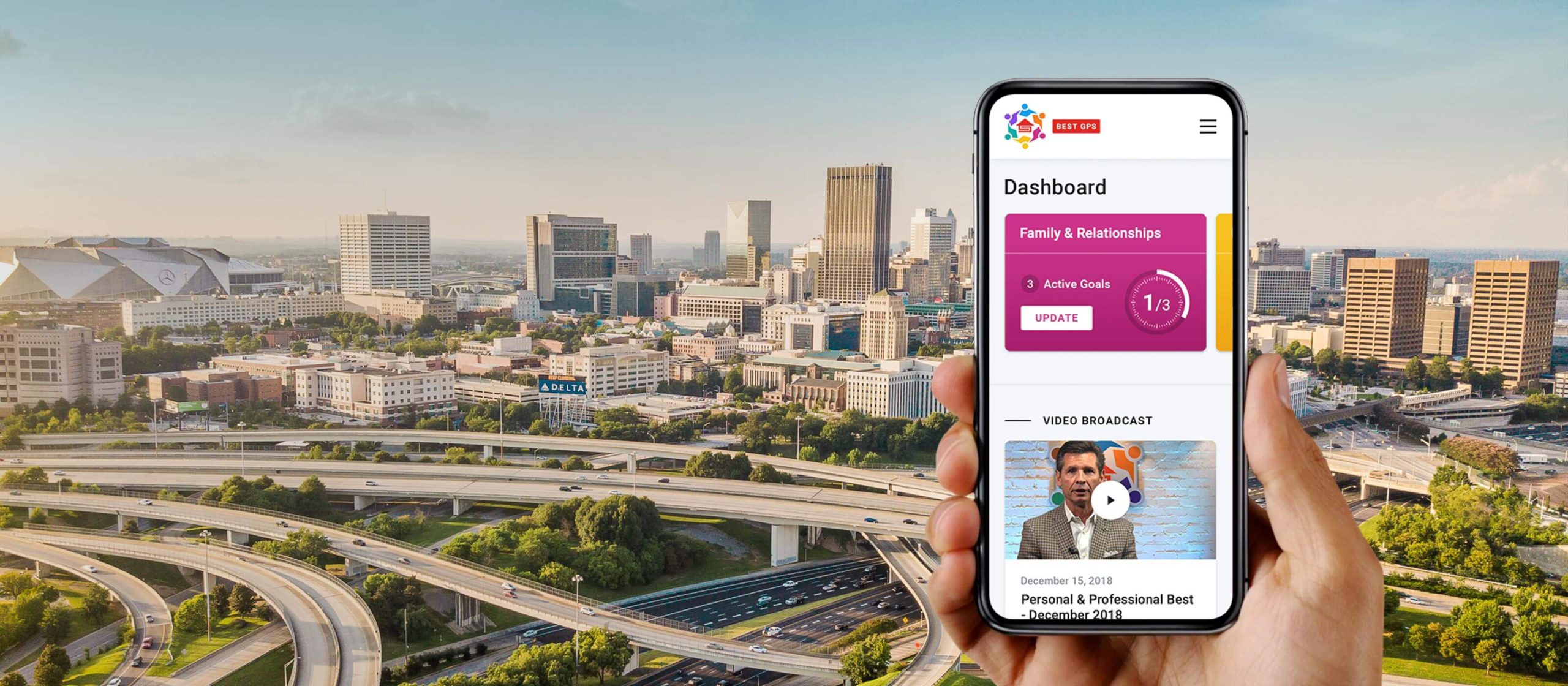

All of us want to become our BEST in life, but few of us have created a plan to get there.

We've developed a system to help you stay on track and accomplish your goals. It works just like your navigation system.

Get StartedAre you interested in a new career in sales, operations, or marketing? Contact us today to find out why Supreme Lending Southeast is the BEST place to work.

Get Started